Hard Money Georgia Can Be Fun For Anyone

Table of Contents6 Easy Facts About Hard Money Georgia ShownExcitement About Hard Money GeorgiaAn Unbiased View of Hard Money GeorgiaHard Money Georgia for DummiesHard Money Georgia Can Be Fun For Everyone

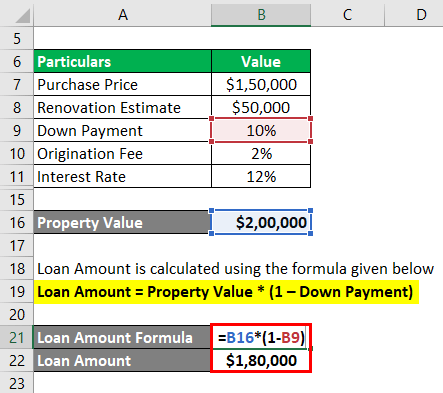

A specific resources barrier is still called for. Difficult money fundings, sometimes referred to as swing loan, are temporary loaning tools that actual estate financiers can use to finance an investment task. This kind of funding is frequently a tool for residence fins or property programmers whose goal is to restore or establish a residential property, after that sell it for an earnings. There are 2 main downsides to consider: Difficult money fundings are hassle-free, but investors pay a cost for obtaining in this manner. The price can be as much as 10 percent factors more than for a traditional lending. Origination charges, loan-servicing costs, and also closing expenses are likewise most likely to set you back capitalists more (hard money georgia).

As a result, these car loans include much shorter repayment terms than conventional home loan fundings. When choosing a tough cash lending institution, it's crucial to have a clear suggestion of just how soon the residential property will become rewarding to guarantee that you'll be able to settle the financing in a timely fashion.

The 10-Minute Rule for Hard Money Georgia

Once again, lending institutions might permit capitalists a little bit of flexibility right here.

Hard cash financings are a good suitable for wealthy financiers who need to get funding for a financial investment residential property swiftly, with no of the red tape that goes along with bank financing. When assessing hard cash lending institutions, pay very close attention to the costs, rate of interest rates, as well as loan terms. If you finish up paying way too much for a difficult money car loan or cut the settlement duration too brief, that can affect how profitable your property endeavor is in the lengthy run.

If you're wanting to purchase a residence to turn or as a rental property, it can be testing to get a traditional home mortgage. If your credit rating rating isn't where a conventional lender would like it or you require cash quicker than a loan provider has the ability to offer it, you could be out of good luck.

Getting The Hard Money Georgia To Work

Difficult cash car loans are temporary safe car loans that make use of the property you're purchasing as collateral. You won't find one from your bank: Tough money lendings are provided by alternate lenders such as private financiers as well as personal business, who normally overlook mediocre credit rating and also various other financial variables and also instead base their decision on the home to be collateralized (hard money georgia).

Hard money finances give a number of benefits for consumers. These include: From start to finish, a difficult money funding may take just a few days.

While hard cash loans come with benefits, a borrower has to also consider the threats - hard money georgia. Among them are: Difficult cash loan providers normally charge a greater rate of interest rate since they're assuming even more danger than a typical loan provider would.

The Ultimate Guide To Hard Money Georgia

You're unclear whether you can manage to pay off the hard cash loan in a brief duration of time. You have actually obtained a solid credit report and need to be able to get approved for a standard car loan that likely carries a reduced passion rate. Alternatives to hard cash financings include typical mortgages, home equity financings, friends-and-family lendings or funding from the building's seller.

Some Ideas on Hard Money Georgia You Need To Know

It is essential to take into consideration factors such as the lender's track record as well as rates of interest. You might ask a relied on real estate agent or a fellow residence flipper for recommendations. Once you've toenailed down the ideal tough money loan provider, be prepared to: Develop the down payment, which typically is heftier than the deposit for a conventional mortgage Gather the needed documents, such as evidence of revenue Potentially employ an attorney to review the terms of the lending after you've been accepted Draw up a technique for repaying the loan Equally as with any look what i found funding, examine the pros and cons of a tough money financing prior to you dedicate to borrowing.

No matter of what type of lending you pick, it's most likely a great idea to inspect your complimentary credit history as well as free credit score record with Experian to see where your finances stand.

When you hear the words "hard cash financing" (or "personal cash loan") what's the very first point that goes via your mind? Shady-looking lending institutions who perform their company in dark alleys and also charge overpriced interest rates? In previous years, some bad apples tainted the difficult cash offering industry when a few predacious loan providers were trying to "loan-to-own", offering really risky loans to debtors making use of real estate as security as well as planning to foreclose on the residential properties.